See the notes on "Short Year Return" Related Links below.

#Due date for 1065 tax returns full

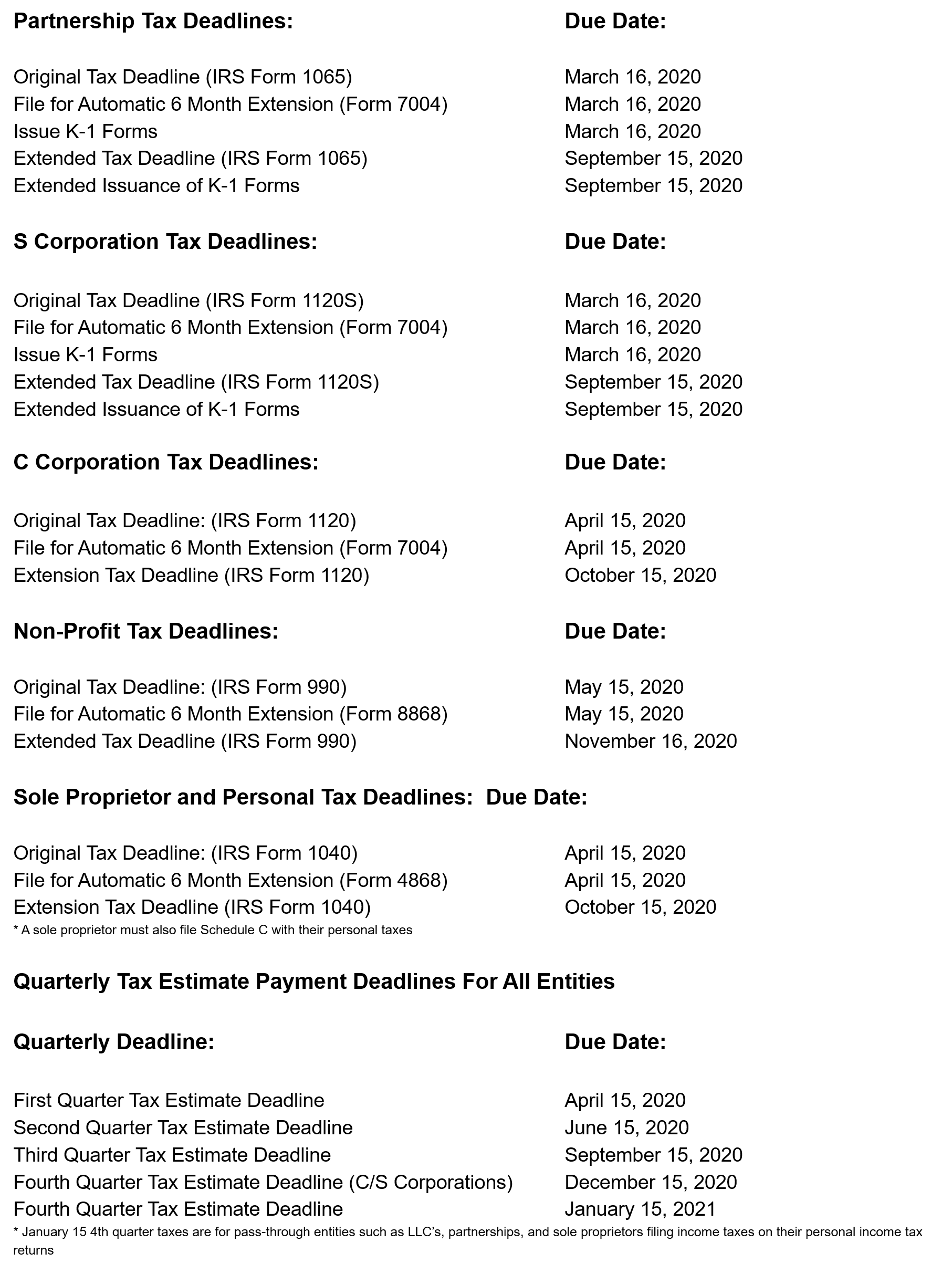

If the return is due before DrakeYY is released, prepare the return in the latest available software, making any adjustments and overrides as needed.May 15 is a Sunday, so the deadline will be the next business day, which is Monday, May 17, 2021. Extension tax deadline for exempt organizations ( Form 990) November 15, 2021. Various federal tax filing and payment due dates for individuals and. with the date of his death, the filing of a return and the payment of tax for a. Original tax deadline for exempt organizations ( Form 990) May 15, 2021. This announcement from the IRS follows a disaster area declaration from the Federal. If it is a short year, follow the steps outlined in "Short Year Return" in Related Links below. A return for a short period, that is, for a taxable year consisting of a.Once DrakeYY is released, you can complete the return in that year of Drake Tax.

If the correct tax year forms will be available before the extended due date of the return, you can file an extension for the return.YY refers to the future tax year program that is not yet available and XX refers to the latest currently available program. In certain situations, a taxpayer may need to file a short-period or fiscal-year return before the newest version of tax software is ready for the next tax year. If a short-year or fiscal-year 20YY return is due before DrakeYY has been released, there are a couple options detailed below. How do I file a short-year or fiscal-year return for a corporation, partnership, or fiduciary return that ended in the current year, when the current-year tax forms are not yet available? If the listed due date falls on a weekend or holiday, the due date is the following business day.

0 kommentar(er)

0 kommentar(er)